The W-9 form is a vital documentation utilized by individuals and organizations in the United States for tax reporting functions. 3 11 23 Excise Tax Returns Internal Revenue Service 3 11 154 Unemployment Tax Returns Internal Revenue Service I 9 Compliance Rules For Production Companies Wrapbook 2021 2025 Form MN DPS PS33203 Fill Online Printable Fillable Blank PdfFiller How To Fill Out Form I 9 Easy Step By Step Instructions YouTube

. Its main function is to provide the Internal Revenue Service (IRS) with precise taxpayer recognition info. Whether you are a professional, freelancer, or small business owner, understanding the purpose and appropriate conclusion of a W-9 form is necessary for compliance with U.S. tax laws.

What is a W-9 Form?

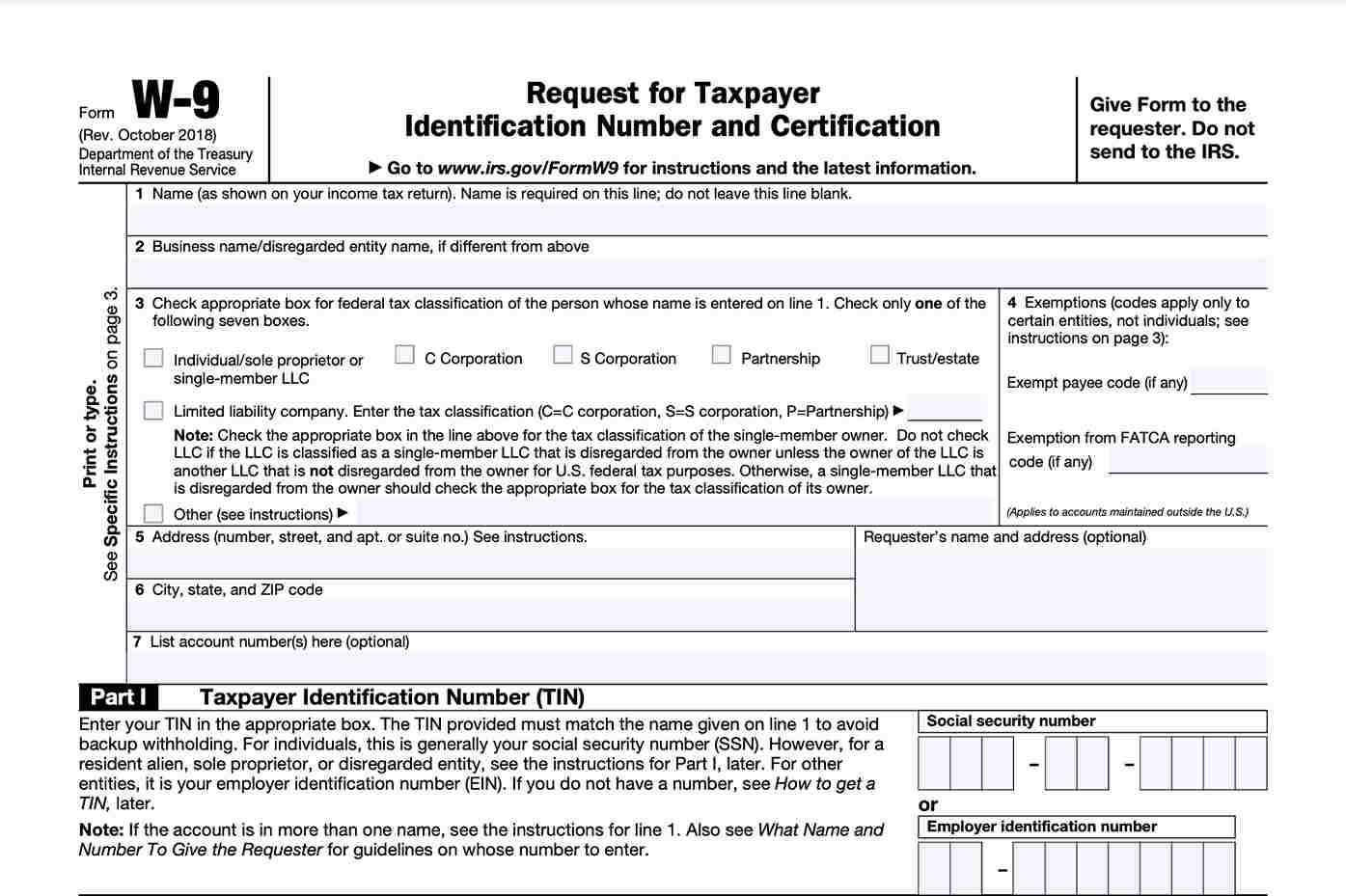

The W-9 form, formally known as the “Request for Taxpayer Identification Number and Certification,” is provided by the IRS. It is mostly utilized by entities to gather the essential details for reporting payments made to non-employees. These payments are often reported on a 1099 form at the end of the tax year. The W-9 form needs the individual or company to provide their name, address, and taxpayer identification number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

Companies, businesses, or entities that pay independent contractors or other company typically ask for a W-9 form. The form ensures that the payer has the proper information for tax reporting and helps the IRS track earnings not subject to standard payroll withholding.

Printable Form 1-9 & W9 Mn

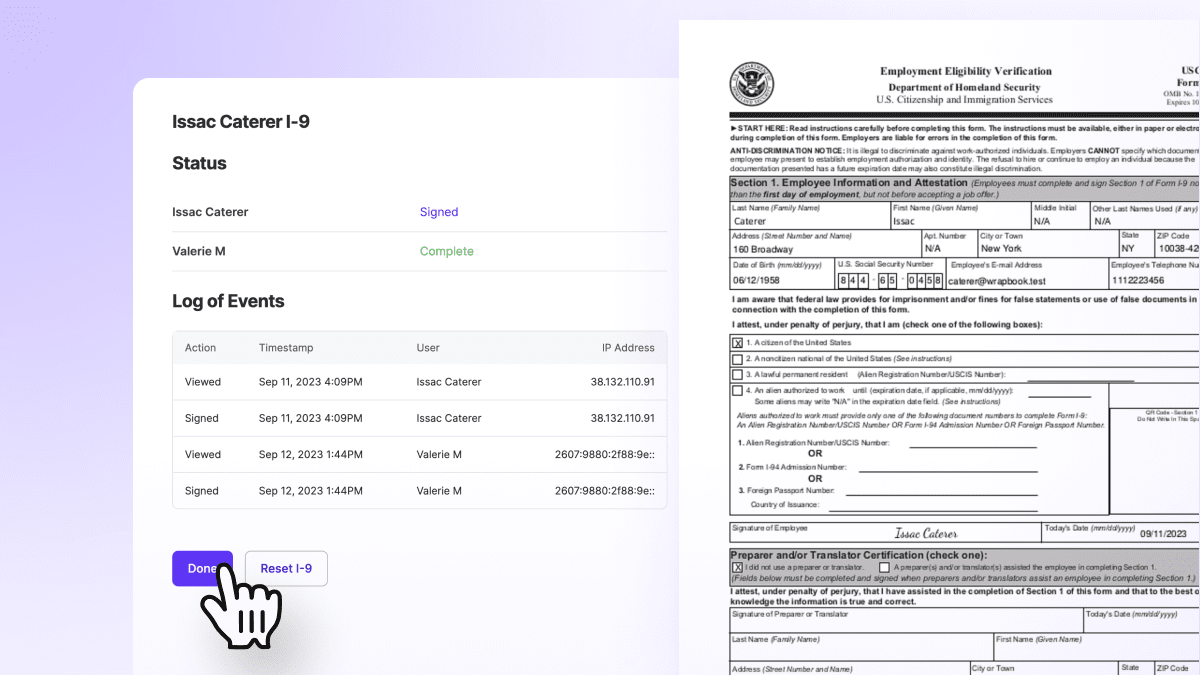

I 9 Compliance Rules For Production Companies Wrapbook

Key Uses of the W-9 Form

Reporting Non-Employee Compensation: Independent professionals, freelancers, and experts are frequently needed to complete a W-9 form when providing services to a business.

Backup Withholding: In cases where an individual stops working to offer the proper taxpayer identification number, the payer may be required to keep a percentage of payments as backup withholding, which is reported to the IRS.

Financial Transactions: Financial organizations might request a W-9 form to report interest earnings, dividends, or other gross income.

Legal Entities: Businesses may also use the W-9 form to gather details from suppliers, suppliers, or other entities they negotiate with throughout the year.

Download Printable Form 1-9 & W9 Mn

Now, since I’m such a huge fan, I wanted to share the love. I’ve created a basic Printable Form 1-9 & W9 Mn that you can save use and I’m using it to you as a free download! You can grab it.

3 11 154 Unemployment Tax Returns Internal Revenue Service

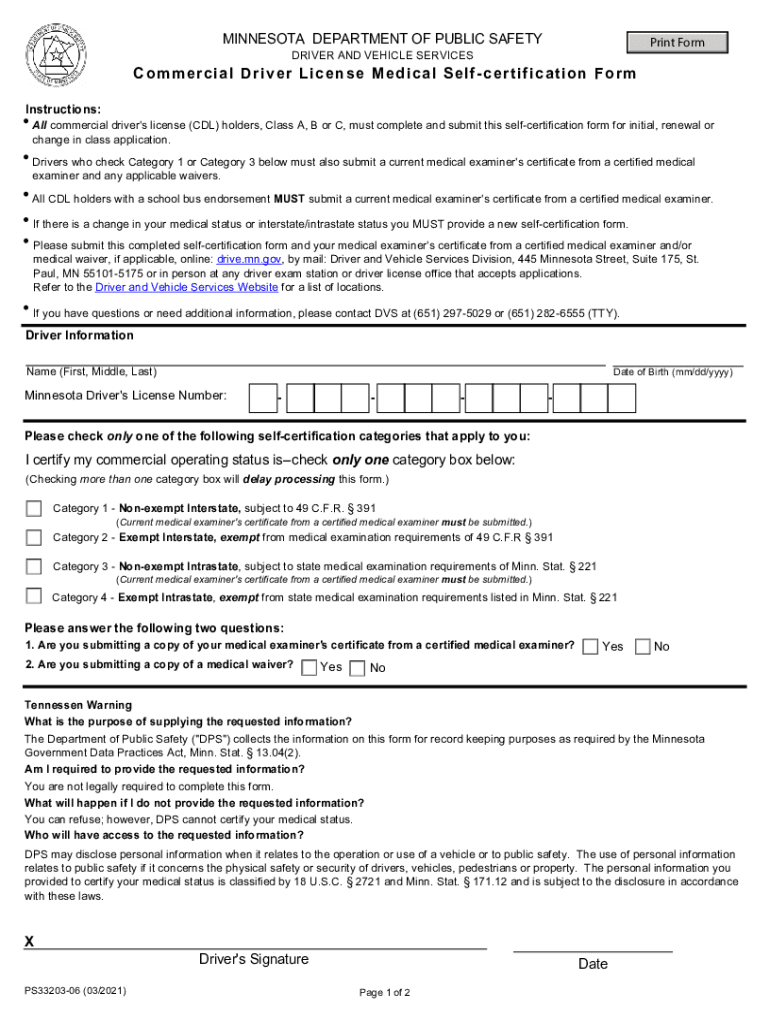

2021 2025 Form MN DPS PS33203 Fill Online Printable Fillable Blank PdfFiller

How To Fill Out Form I 9 Easy Step By Step Instructions YouTube

Free I 9 Form Employment Eligibility Verification PDF EForms

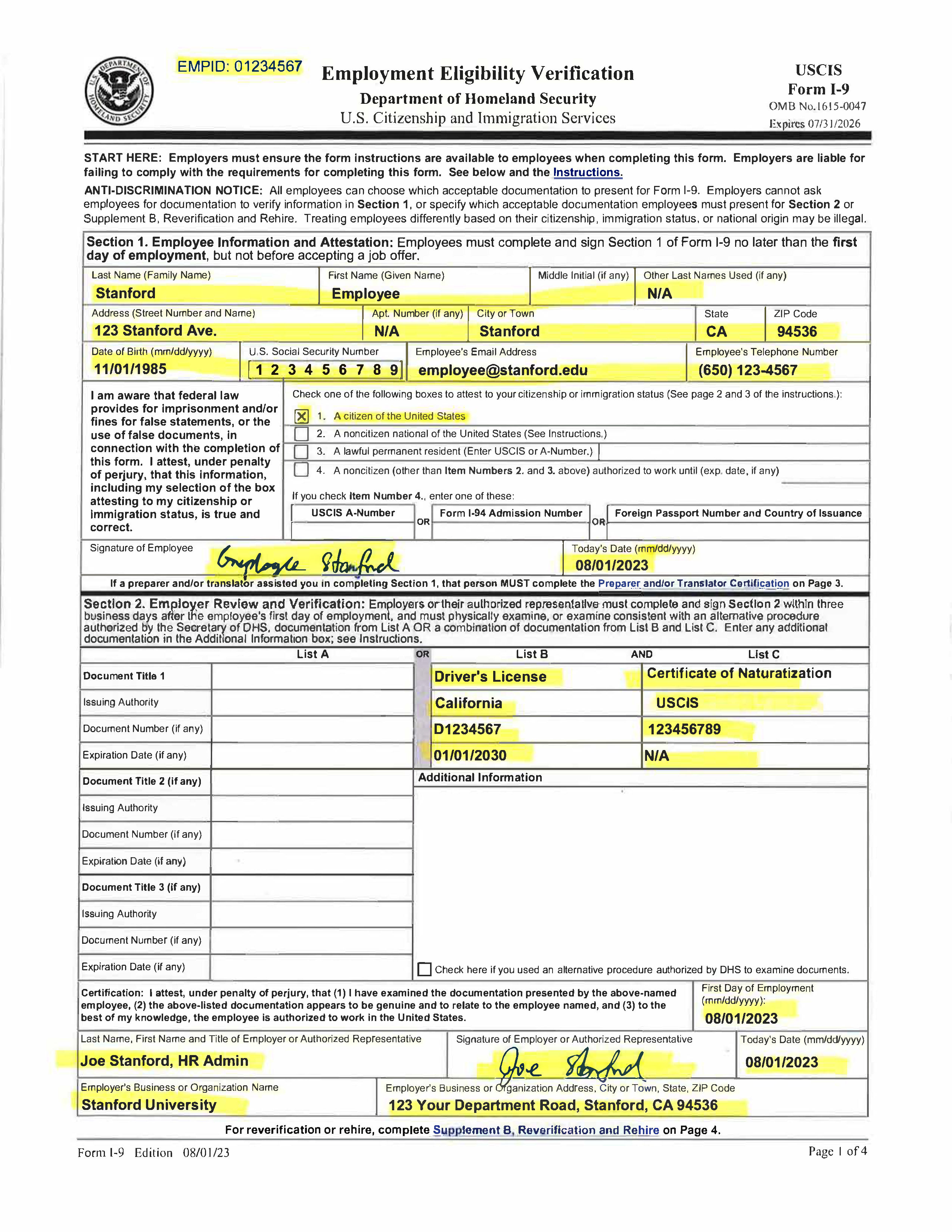

Examples Of Completed Form I 9 For Stanford

W-9 Form Printable Form

The W-9 form is readily available as a printable documentation, making it hassle-free for people who prefer a physical copy. The official IRS site provides the most current variation of the form in PDF format, which can be downloaded and printed as needed. Services that need hard copies of W-9 forms for record-keeping functions typically go with this format.

When utilizing the printable variation, it is important to make sure that all areas are completed legibly. After filling out the form, it must be signed and dated by the specific supplying the information. The completed form can then be returned to the requester either by mail or hand shipment. It is a good idea to keep a copy of the completed W-9 form for personal records.

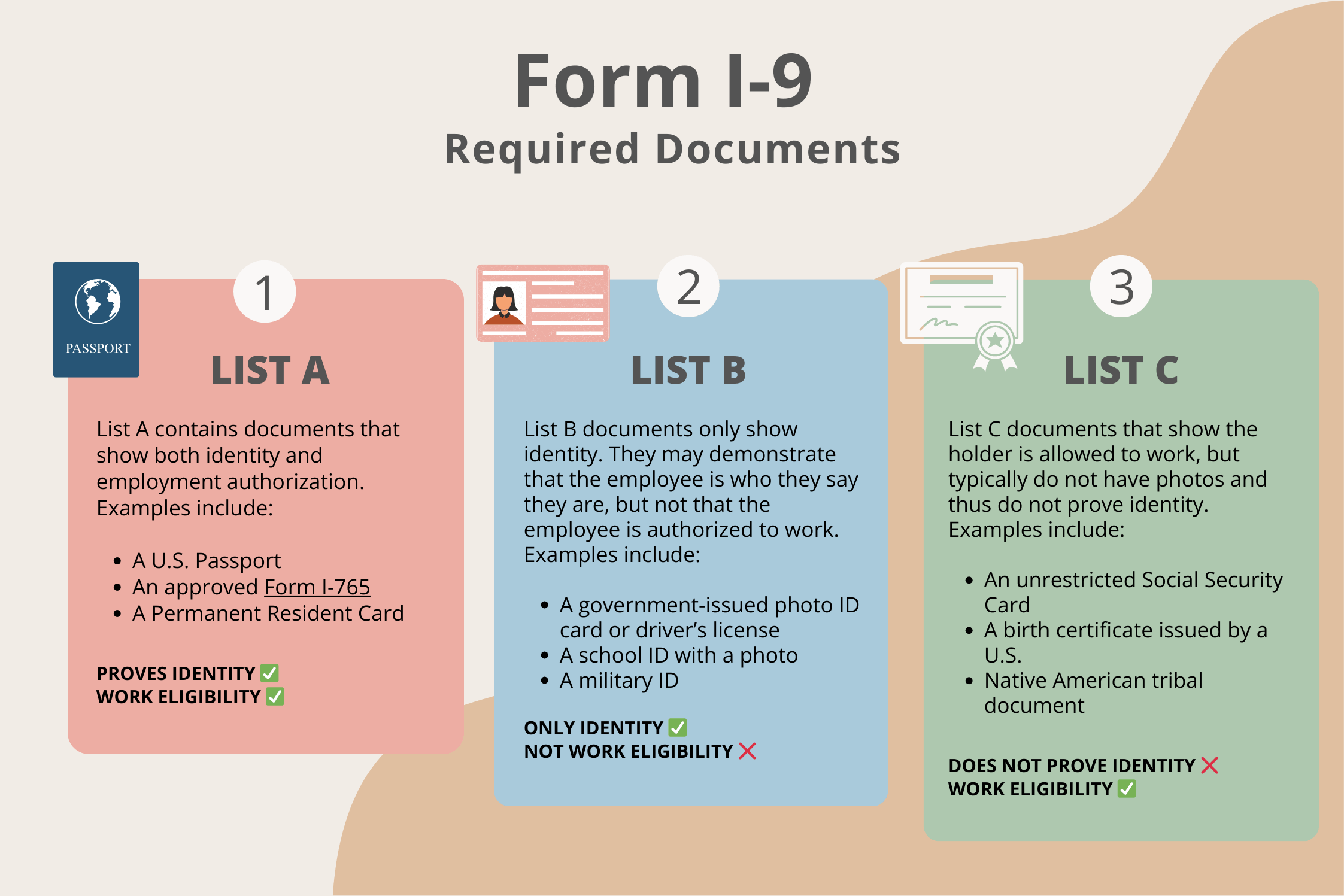

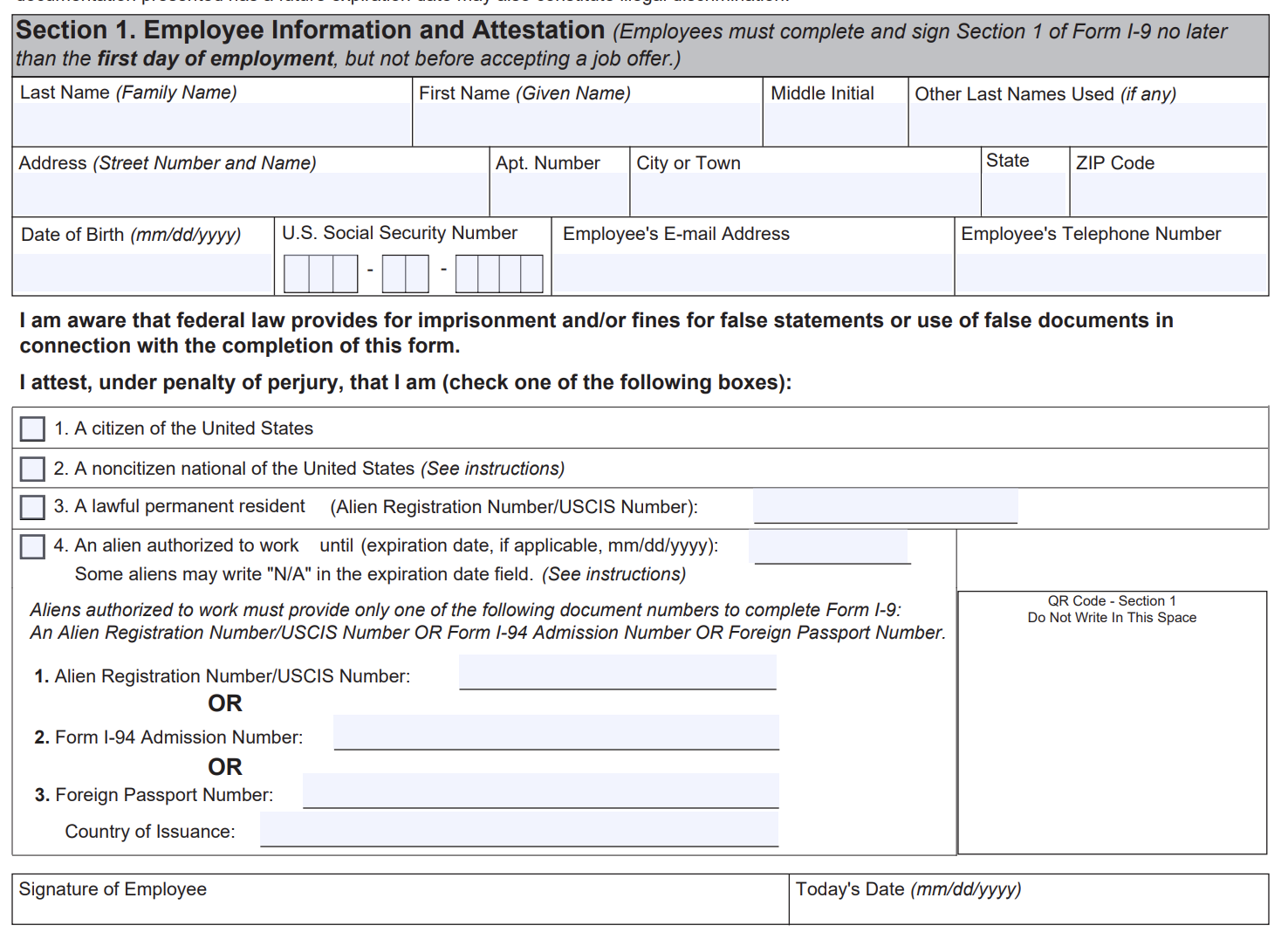

What Is Form I 9

What Is Form I 9

Fillable Form W-9

For those who prefer a digital choice, the IRS likewise offers a fillable variation of the W-9 form. This format is especially beneficial for individuals and organizations that focus on effectiveness and precision. The fillable W-9 form can be completed straight on a computer system or mobile phone, decreasing the threat of mistakes caused by illegible handwriting.

To use the Printable Form 1-9 & W9 Mn, download the PDF from the IRS site and open it using a compatible PDF reader. Go into the needed information in the designated fields, consisting of name, company name (if appropriate), address, TIN, and federal tax category. Once all fields are completed, the form can be digitally signed and saved. The saved file can then be firmly shown the requesting entity via e-mail or an encrypted file-sharing service.

Security and Privacy Considerations

Given the sensitive nature of the information required on the W-9 form, it is essential to manage it firmly. Avoid sharing finished W-9 forms through unsecured e-mail or public platforms. Instead, use encrypted file-sharing services or deliver the form in person whenever possible. Additionally, validate the authenticity of the requesting entity before supplying any individual information.

Typical Mistakes to Avoid whil filling Printable Form 1-9 & W9 Mn

Providing Incorrect Information: Double-check all entries, especially the TIN, to avoid hold-ups or issues with tax reporting.

Stopping working to Sign the Form: Unsigned forms are thought about incomplete and might lead to backup withholding.

Utilizing Outdated Forms: Always utilize the latest variation of the W-9 form, offered on the IRS site.

Form W 9 And Taxes Everything You Should Know TurboTax Tax Tips Videos

sources : turbotax.intuit.com

The Printable Form 1-9 & W9 Mn plays a crucial function in preserving compliance with U.S. tax laws for both individuals and companies. Whether you select the printable form or the fillable form W-9, making sure accuracy and security is vital. By comprehending the purpose and proper completion of the W-9 form, you can help with smooth transactions and prevent potential tax-related issues. Always consult a tax professional if you have concerns or issues concerning the W-9 form or its use 3 11 23 Excise Tax Returns Internal Revenue Service 3 11 154 Unemployment Tax Returns Internal Revenue Service I 9 Compliance Rules For Production Companies Wrapbook

.